If you are receiving workers’ compensation benefits or are expecting your first check, it is essential to know the signs it might be late. Understanding your rights and the processes your employer or carrier should follow can help ensure you always receive your benefits on time.

When Should I Expect to Receive My Workers’ Compensation Check?

When you receive your workers’ comp check will depend on the notification process. If you get sick or injured at work, you should file a notification with your employer or workers’ compensation provider as soon as possible. Ideally, you should file within 21 days of the injury or sickness, but you have until 120 days after to file. Waiting to file your claim can push back when you receive your benefits.

After you issue the notification of your injury, your employer or provider has 21 days to decide whether to accept or deny your claim. As soon as your employer or carrier approves your compensation, you will be able to begin receiving benefits. If your employer or provider denies your claim, you will have up to three years from the date of the injury to file a petition to appear at a hearing before a judge to try and have their denial overruled.

Your employer can only make payments after the first seven days you have missed work. After this initial period, you can begin receiving your benefits. After the first 14 missed workdays, you can receive retroactive payments for the first seven workdays.

According to section 308 of the Pennsylvania’s Workers’ Compensation Act, you will receive your compensation payments at the same frequency as your previous wages from your employer. You should get the first payment within 21 days of the initial date of injury. If you received your wages weekly, you should now receive workers’ comp payments on the same cycle. The same goes for biweekly, monthly or other payment patterns.

You should also get payments on the same day you normally received your regular paychecks. In other words, if your employer paid you on Fridays, you should expect your workers’ compensation payments to arrive on Fridays. Understanding the frequency, patterns and timelines for receiving your workers’ comp benefits can help you recognize when payments might be late.

What Will My Workers’ Compensation Benefits Cover?

In addition to knowing when you’ll receive your workers’ comp benefits, you should also know what benefits you can receive. Benefits will change to fit the person’s individual needs and depend on the coverage plan from your employer’s workers’ compensation carrier. Some benefits include:

Medical coverage

Many employees require medical attention and treatment after getting injured. Workers’ compensation medical benefits help provide coverage for doctor’s visits, prescriptions, aids and equipment, and even hospitalization or surgeries that are related to your work injury.

Employers and carriers may also require employees to undergo exams and treatments with approved doctors within the first 90 days following an employee injury to ensure the injury fits workers’ comp needs. Failure to seek initial treatment from an approved physician may mean an employer isn’t liable to cover the costs of care you incurred.

After 90 days of treatment, injured employees can see a medical caregiver of their choice. If no list of panel providers is given to an employee after the injury, the employee may consult with a physician of his or her choice. Other exceptions may also apply where employees can seek care from their preferred provider. These include medical emergencies, compliance violations like improper panel composition and a failure to comply with posting requirements.

Wage-loss payments

When people refer to workers’ compensation checks, this is usually what they mean. Wage-loss benefits help provide employees with income because they can no longer return to work or because their wages are lower as a result of the injury. These benefits are what you should receive on your usual payday.

These payments typically fall into two categories. Temporary total disability payments provide income benefits when recovery and a return to full duty are possible or predicted. When a full recovery is doubtful, an injured worker will likely qualify for permanent total disability benefits instead.

Vocational rehabilitation

While employees might need physical therapy to help them recover from their injuries, vocational rehab can help train them to return to work with their restrictions. The program helps place employees at jobs or positions that fit their abilities and limitations, so they can continue to work while they recover or in the face of permanent disabilities.

However, this program is optional, and most employers only use it if there are no other options and against an employee in court to lower benefits by showing that they have an earning capacity.

Other Situations

In some cases, additional benefits may be available. Survivors may be able to recover death benefits if an employee’s injury is fatal. Specific loss benefits may also be an option in situations where the employee loses limbs, appendages or senses or experiences a permanent disfigurement.

Additionally, employees in certain occupations may have other compensation laws that apply specifically to them. These include those working for the federal government, railroads and shipyards.

Because Pennsylvania offers so many different workers’ compensation benefits, knowing what you have available can help you when entering the workers’ comp process.

How Much Will My Workers’ Compensation Check Be?

Under the Pennsylvania Workers’ Compensation Act, your wage loss benefits will equal two-thirds of your average weekly wage. The Department of Labor and Industry (DLI) establishes annual maximums and minimums for workers’ comp benefits based on Pennsylvania’s average weekly wage, so your benefits can reflect these amounts. Because the maximums and minimums change each year, your benefits will reflect the range from the year of your injury. While these amounts fluctuate annually based on prevailing average weekly wages, there is no cost of living adjustment automatically applied to raise your benefits. In short, the thresholds in effect during the year your injury occurred will remain in place for your benefit even as future rates change.

How Do I Track My Workers’ Compensation Check?

If you are worried about your workers’ compensation payments being late, you can create a system to help you track your payments. Following your workers’ compensation payments can alert you when your employer or provider might be late with payments so you can take the right measures sooner.

Your workers’ comp check being late could be due to a myriad of reasons. Taking the steps below can help you determine what to do if your workers’ comp checks are late:

- Determining the timeline: The first step in tracking your workers’ compensation payments is to determine when everything should happen. Review when you first notified your employer and submitted claims since that can determine when they need to take action under Pennsylvania law. Because employers need to follow payment cycles, tracking and understanding that timeline can also help you track when you should receive payments.

- Saving older files: In Pennsylvania, you can determine when you should receive your benefits based on when and how frequently you would receive wages. You can track when you should receive benefits by gathering bank statements or paystubs that prove when your employer typically paid you.

- Gathering relevant evidence: As you begin receiving payments, you can further track your payments by saving when you receive your benefits. Whether you get a check in the mail or a direct deposit, you can establish a payment schedule that you can use to track your benefits.

- Contacting an attorney: If you need a more thorough way to track your benefits or think they might be late, you should contact an attorney. Their firms will have the resources you need to establish timelines or evidence. They can also communicate with other parties, like employers and workers’ comp providers.

Creating a system to efficiently track your workers’ compensation payments and benefits can help you when payments are late. When you understand what regular payments look like, you can react quickly when your payments are late.

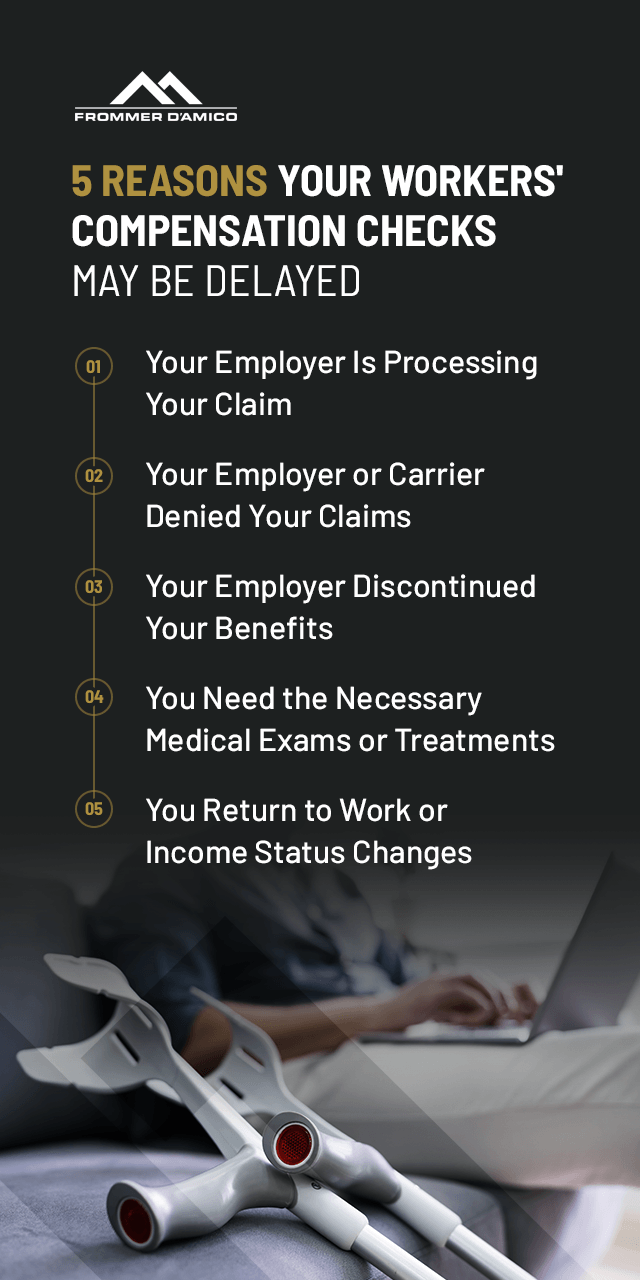

5 Reasons Your Workers’ Compensation Checks May Be Delayed

Workers’ comp payments can be delayed for several reasons, from processing to policy changes. While understanding when you should receive payments can ensure you are ready when payments are late, you should also know some common reasons behind delayed or stopped payments.

1. Your Employer Is Processing Your Claim

If you have just submitted your notification to your employer or workers’ comp provider and haven’t received your benefits yet, they might still be processing your claim. Employers have 21 days after receiving your notification to accept or deny it. If you are still waiting for your first wage-loss payment, it is possible your employer and carrier have yet to make a decision.

Be sure to track the appropriate time for every step in the claims process to know exactly when your payments become late. Keep copies of everything you submit and receive and the dates if you can. If you need to appear before a judge to receive benefits, you can use these pieces of information as evidence in your favor.

2. Your Employer or Carrier Denied Your Claims

If you haven’t received a payment from your employer and it has been 21 days since you filed your claim, your employer might have denied it — an increasingly common occurrence for valid claims.

Generally speaking, most employers must carry workers’ compensation insurance that covers employees beginning on their first day of employment. Options for doing so include:

Self-insuring.

Contracting with an approved carrier or insurance broker.

Joining the State Workers’ Insurance Fund (SWIF).

Exceptions can apply, though, and some employers hold the right to refuse to pay workers’ compensation. Employees still have options when seeking compensation in these instances. You can reach out to the Bureau of Workers’ Compensation to see if you can receive money from the Uninsured Employer Guaranty Fund.

If your benefits are late because your employer or carrier denied your claims, consider partnering with a lawyer who can help you file an appeal and navigate your options and any possible hearings.

3. Your Employer Discontinued Your Benefits

Your employer or workers’ comp carrier can discontinue benefits if they file a Notice stopping your benefits along with a Notice of Denial of your claim. When they file this notice, they must include the reason for stopping benefits so employees can understand why they are no longer receiving payments. One common reason employers discontinue workers’ compensation benefits is employee restrictions.

To receive benefits, employees often have to submit work restrictions that will limit what they can do. If an employee returns to work without restrictions or a doctor no longer issues them, an employer or carrier might believe they are fit to work again. You should contact an attorney if you still have restrictions in place and your employer cites this as their reason to file the discontinuation.

When they deny your claim to continue receiving compensation, you will have to file a petition to overturn their ruling up to three years after your most recent payment. If there are any changes to your workers’ compensation, you should also receive a notification.

4. You Need the Necessary Medical Exams or Treatments

Many employers, carriers and judges use medical exams and treatments to assess your injury and healing. Your employer might ask you to take a medical exam or show proof or treatment to see if you are still unfit to return to work. Because doctors can apply and update restrictions, exams and treatments are helpful for employees who are still working while receiving compensation.

If you need to appear before a court in a hearing, medical proof can be powerful evidence when arguing for workers’ compensation. Providing this information can help a judge side in your favor if you need workers’ comp. Refusal to take or submit medical proof can lead employers, providers and judges to suspend your workers’ compensation benefits.

5. Your Return to Work or Your Income Status Changes

Thankfully, some workplace injuries or illnesses are not permanent. If restrictions lift or a medical professional deems you fit to return to work, your employer can offer you a job. Accepting the job offer can terminate your workers’ compensation payments.

Some employees experience long-term effects from their injury, making it harder to return to work without restrictions or at their previous capacity. While you work, you can still receive some benefits to replace lost wages or cover disability needs. If you make the same or more than what you earned before your injury, your employer or provider can stop benefits.

Regardless of the conditions, if your employer or provider decides to change the status of your workers’ compensation benefits, you should receive some notification clarifying the reasoning. The most common is the Petition to Terminate, Modify or Suspend Benefits because it covers many situations and communicates the necessary information to employees.

3 Steps to Take if Your Workers’ Compensation Check Is Late

Like notifying your employer of your injury, acting as soon as possible when you realize payment is late can help you get back on track more efficiently. You can do so faster by learning the actions you can take to receive late payments and guarantee future payments come on time.

1. File Penalty Petition

If one or more of your workers’ compensation payments are late, you can submit a penalty petition. This form will allow you to demand more timely payments that meet state legal requirements. Filing this petition will require you to appear before a judge and present evidence.

The petition also allows you to receive interest rates and penalty payments on missed benefits. Since late payments can disrupt essential expenses like rent, food or even medical needs, the Penalty Petition can help you receive regular payments and reimburse you for the inconvenience the lateness caused.

2. Prepare Evidence

Because you will need to appear in court and prove the payments are late, you must prepare and provide evidence for the judge to assess. You should prove when you received all late payments by either bringing checks with postmarks or bank statements with direct deposit dates.

Saving older payment history can also help the judge understand if payments are late. If you can prove when you typically receive payments with older checks and statements, you can establish regular payment expectations that help your case.

3. Contact a Lawyer

A lawyer can help you navigate court and hearing proceedings, ensuring that you have prepared everything you need and understand what you will need to do. Partnering with a lawyer who specializes in workers’ compensation cases will ensure you work with someone who understands your needs and has experience advocating for people in your situation.

At Frommer D’Amico, we can help you through all aspects of your workers’ compensation journey, from representing you during court hearings and litigation to answering your questions and calls, including handling late payments. As a firm specializing in helping employees receive workers’ comp, we are familiar with the processes and understand what we need to do to help you.

Contact a Workers’ Compensation Lawyer Today

Late wage-loss benefits can be stressful for people depending on workers’ compensation benefits. Because many employees have to wait to return to work or restrictions and injuries will cause them to earn less, they often depend on benefits to help cover essentials.

If you are in this situation, having an experienced lawyer you can trust can help streamline processes and navigate complications in receiving your workers’ compensation. Attorneys at Frommer D’Amico are specialists in workers’ compensation and its various litigation.

Our attorneys are devoted to protecting employee rights and handle only workers’ compensation cases on behalf of injured employees — we never represent employers or insurers. We will work with you to provide personalized care for all your needs, from specifics like late payments to general payments. We are available whenever you need us, including on the weekends and evenings.

Put your trust in workers’ comp experts, and contact Frommer D’Amico today.