Table of Contents

Free Case Review in PA Get the $ You Deserve

If you are out of work due to an injury suffered on the job or a work-related illness, you are entitled to workers’ compensation. Your first question is, “How much do I get paid on workers’ compensation?” or “What do PA workers’ compensation rates look like?” You need to plan your budget for the coming months, so that’s a valid and important question.

Workers’ compensation in Pennsylvania was created to compensate you for lost wages and help cover medical bills. Yet, you should not expect to receive your full salary while on workers’ compensation. Benefits will pay a part of your salary. Payments are designed to help you get through a difficult time — not compensate you as though you were working full-time.

So, what percentage of your pay do you get for workers’ compensation? This amount depends on several factors, most importantly when you apply for benefits. Let’s explore how workers’ comp weekly benefits are calculated in 2024 and previous years.

How Are Workers’ Comp Benefits Calculated in Pennsylvania?

The Pennsylvania Workers’ Compensation Act of 1915 entitles individuals injured on the job to wage-loss benefits up to two-thirds of their average weekly salary.

Almost all employers in Pennsylvania purchase and maintain Workers’ Compensation Insurance. This ensures injured employees are financially compensated for their economic losses after a workplace accident or occupational illness.

The Pennsylvania Department of Labor and Industry (DLI) calculates the statewide average weekly wage each year. Your benefits depend on where your salary falls within the weekly minimums and maximums based on a formula set up by the state. For instance, in 2014, the weekly maximum wage you could receive for workers’ compensation was $932. In just five years, that amount rose by more than $100.

Your average weekly wage is the primary basis for all workers’ compensation calculations. This figure is based on gross wages — your pre-tax income — not net wages received after taxes. Your gross wage should include all income from every employer you have at the time of injury. It should also take into account tips, gratuities, paid time off, bonuses, overtime and even vacation pay.

Calculating your average weekly wage depends on what you received the year preceding your workplace injury. For example, if you were injured on January 15, 2024 — your average weekly wages would be calculated from the income you received from January 15, 2023, until January 14, 2024.

If you settle a workers’ compensation case for a lump sum, you will not receive weekly payments. Instead, you’ll agree to a total that may also cover your medical bills. The terms of every settlement are different, so your experience won’t be the same as someone else’s, even if they suffered an identical on-the-job injury.

Before accepting any settlement, consult a workers’ comp attorney to ensure you get the best deal.

What Are Workers’ Compensation Rate Schedules?

The workers’ compensation rate schedule is the benefit scale updated by the Pennsylvania DLI every year.

Pennsylvania rates are calculated using a formula set up by the state. While the formula is the same for every worker, the amount you receive will be different since it’s based on salary. The more you make, the lower the percentage of your salary you retain, but if you earn a lower wage, you get to keep more of it.

Pennsylvania updates the maximum compensation and the worker’s compensation rate schedule annually. The maximums and minimums are based on statewide average weekly wages, as calculated by the Department of Labor and Industry. So, your compensation rates will differ depending on the year your injury occurred.

The schedule is broken down into four blocks representing the annual benefit rate for that year.

Block 1: Those who make more than a certain amount are entitled to that year’s maximum payment.

Block 2:Being in the second block makes you eligible for two-thirds of your salary.

Block 3: Those in the third block receive a standard weekly rate.

Block 4: If an employee’s weekly wage is less than a certain amount, they receive 90% of their weekly salary.

When referencing the workers’ compensation rate schedules, read down the column to find the block that best represents your average weekly wage for the calendar year your injury occurred. This will indicate how much you should get paid under Pennsylvania workers’ compensation.

Workers’ Compensation Pennsylvania Rates for 2024

For 2024, the Pennsylvania DLI determined the maximum compensation for workplace injuries to be $1,325 a week. This represents an average weekly wage increase of 4% from last year.

If your injury occurred on or after January 1, 2024, here is the workers’ compensation rate schedule for 2024:

Block 1: Employees who make more than $1,987.50 are in the first block, which qualifies them for this year’s maximum payment of $1,325.

Block 2: If your average weekly wage falls between $993.76 and $1,987.50, your weekly compensation is 66 ⅔% of your salary.

Block 3: Those with an average weekly wage between $736.11 and $993.75 receive a weekly compensation rate of $662.50.

Block 4: Those whose average wages are $736.10 or less can receive 90% of their average weekly wage.

Regardless of how high your wages are, you may not receive more than the 2024 maximum workers’ compensation rate for PA.

What Was the Weekly Benefit Rate Before 2024?

Did you file for workers’ compensation before 2024? In previous years, the payout amounts and the salaries included in each block differed. Use the information below to determine which benefits you may qualify for.

At Frommer D’Amico, we understand that crunching the numbers can feel daunting, especially for new claimants and those with older cases. If you have questions, our legal team is available to answer them. No matter when you filed for workers’ comp, you deserve the benefits you’re entitled to.

2023 Pennsylvania Workers’ Compensation Rates

For those injured in 2023, the maximum compensation for employees in block one was $1,273. Those who made between $954.76 and $1,909.50 were in the second block and qualified for 66 ⅔% of their average weekly wage. The third block average wage was for those with salaries between $707.22 and $954.75. They received a weekly amount of $636.50. Finally, those in the fourth block who made less than $707.21 could receive 90% of their average weekly wage.

2022 Pennsylvania Workers’ Compensation Rates

If you were injured on or after January 1, 2022, here is the workers’ compensation rate schedule for that year:

Block 1: The maximum weekly compensation rate for 2022 was $1,205.

Block 2: Those with an average weekly wage between $903.76 and $1,807.50 could receive two-thirds of their salary.

Block 3: An average weekly wage of $669.44 to $903.75 is entitled you to $602.50.

Block 4: The fourth block and 90% compensation were reserved for those who made less than $669.43 weekly.

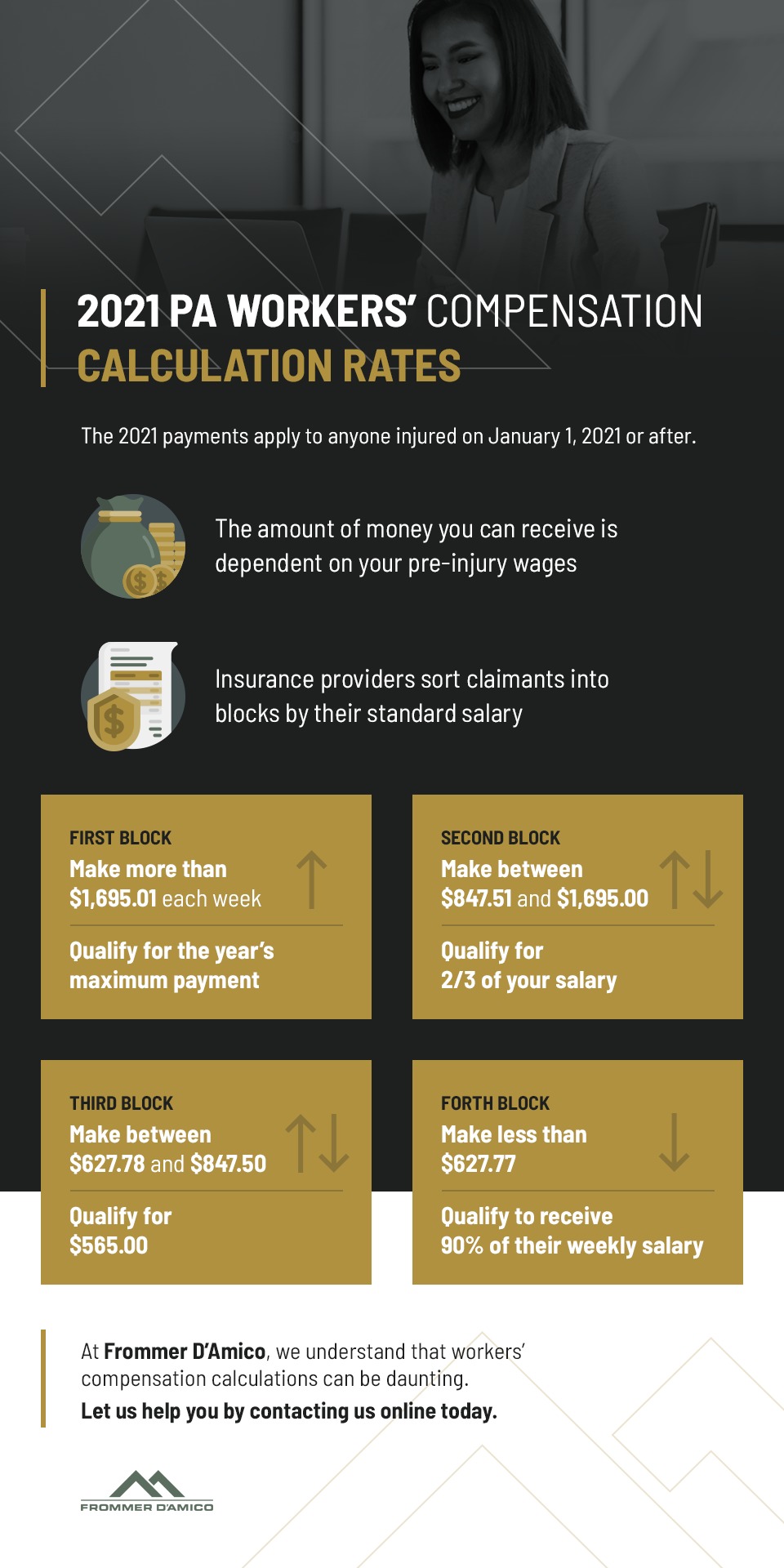

2021 Pennsylvania Workers’ Compensation Calculation Rates

In 2021, Pennsylvania’s Department of Labor and Industry set the maximum compensation rate for injured employees at $1,130.00 per week. This rate reflects a 4.6% increase from the average weekly wage in 2020.

Employees in the first block who made more than $1,695.01 each week qualified for 2021’s maximum payment. Those who qualified for the second block had a weekly salary between $847.51 and $1,695.00. Being in the second block made you eligible for two-thirds of your salary. If you received less than $847.50 but more than $627.78, you were in the third block and could receive $565.00. Claimants who made less than $627.77 received 90% of their weekly salary.

2020 Pennsylvania Workers’ Compensation Rates

The 2020 payments apply to anyone injured on January 1, 2020, or after. In 2020, the maximum amount paid out to anyone in the state had risen compared with 2019. The high end was $1,081. The statewide average weekly wage rose 3.1% in 2020.

Employees who made $600.55 or less per week were entitled to 90% of their weekly average salary. If your salary was high, somewhere between $810.76 and $1,621.50 per week, then you would receive two-thirds of that for your workers’ compensation benefits. Workers’ comp paid $540.50 each week if your pre-injury earnings were between $600.55 and $810.75 a week in 2020.

Pennsylvania Workers’ Compensation Rates in 2019

To figure out how much you would have gotten paid, grab a pay stub and use our directions to find the number.

Here’s how PA workers’ compensation benefits were calculated for 2019. First, determine your average weekly salary from the year when the injury occurred. Then, see which category you fell into. If your average weekly salary was:

Above $1,573.50, then your weekly benefit would have been $1,049.00. That’s the maximum weekly benefit that was available to anyone in the state.

Between $1,573.50 and $786.76, multiply that number by 2/3. The number you get would have been your weekly benefit.

Between $786.75 and $582.78, your weekly benefit would have been $524.50.

Below $524.50, then multiply it by 0.9. The number you get would have been your weekly benefit.

2018 Pennsylvania Workers’ Compensation Rates

The maximum payout in 2018 was less than it was in 2019. Workers could bring home a maximum of $1,025 each week, no matter what they made at their job. The payout was once again adjusted based on your average income level.

2018’s maximum payout meant that if two-thirds of your salary were above $1,025, you wouldn’t get any more money — your workers’ compensation was capped.

Workers making between $768.76 and $1,537.50 per week in 2018 received two-thirds of that as their weekly benefit. Those who made $569.44 to $768.75 received $512.50 per week. And those who made less than $569.43 per week earned 90% of their salary in 2018.

2017 Pennsylvania Workers’ Compensation Rates

PA workers’ compensation rates in 2017 were below 2018’s rates. In fact, they have risen year-to-year since at least 2015. In 2017, the maximum benefit a worker could bring home weekly was $995. 2018 marked the first time that number rose above $1,000.

Those making $746.26 to $1,492.50 are paid two-thirds by comp. If you made $552.78 to $746.25 earned weekly benefits of $497.50. And workers whose weekly compensation fell below $552.77 were entitled to 90% of that salary for workers’ compensation.

PA Workers’ Compensation Calculator

How much does PA workers’ compensation pay? If you’re still unsure about the Pennsylvania workers’ comp rate, use the calculator available through the Pennsylvania Department of Labor and Industry. This workers’ compensation payment calculator shows the yearly compensation maximums and minimums.

Let Our Team Help Your Get Your Maximum Compensation Rate

Don’t want to figure out your average weekly wage? The experienced workers’ compensation attorneys at Frommer D’Amico in Harrisburg, PA can help you calculate your maximum rate and protect your rights.

Workers’ comp cases are our specialty. We represent only employees — never employers — in these cases, and we offer lower fees. If you are concerned about your workers’ compensation payments or other aspects of your situation, get in touch with us today to discuss your case.

Contact us online to file a claim, or give us a call at 717-400-1405.

Related Resources

Joe D’Amico has more than 20 years of experience fighting for injured workers. He is Certified as an Expert in Pennsylvania Workers’ Compensation Law by the Supreme Court of Pennsylvania. Joe is one of the very few Pennsylvania workers’ compensation attorneys who have obtained a recovery in excess of $1.5 million for an injured worker.

Reviewed by Joe D’Amico.